INSR.tech is pleased to endorse its experience in partnering NeoITO for their development of our dynamic risk engine and web application.

Sander Hansen

Founder, INSR

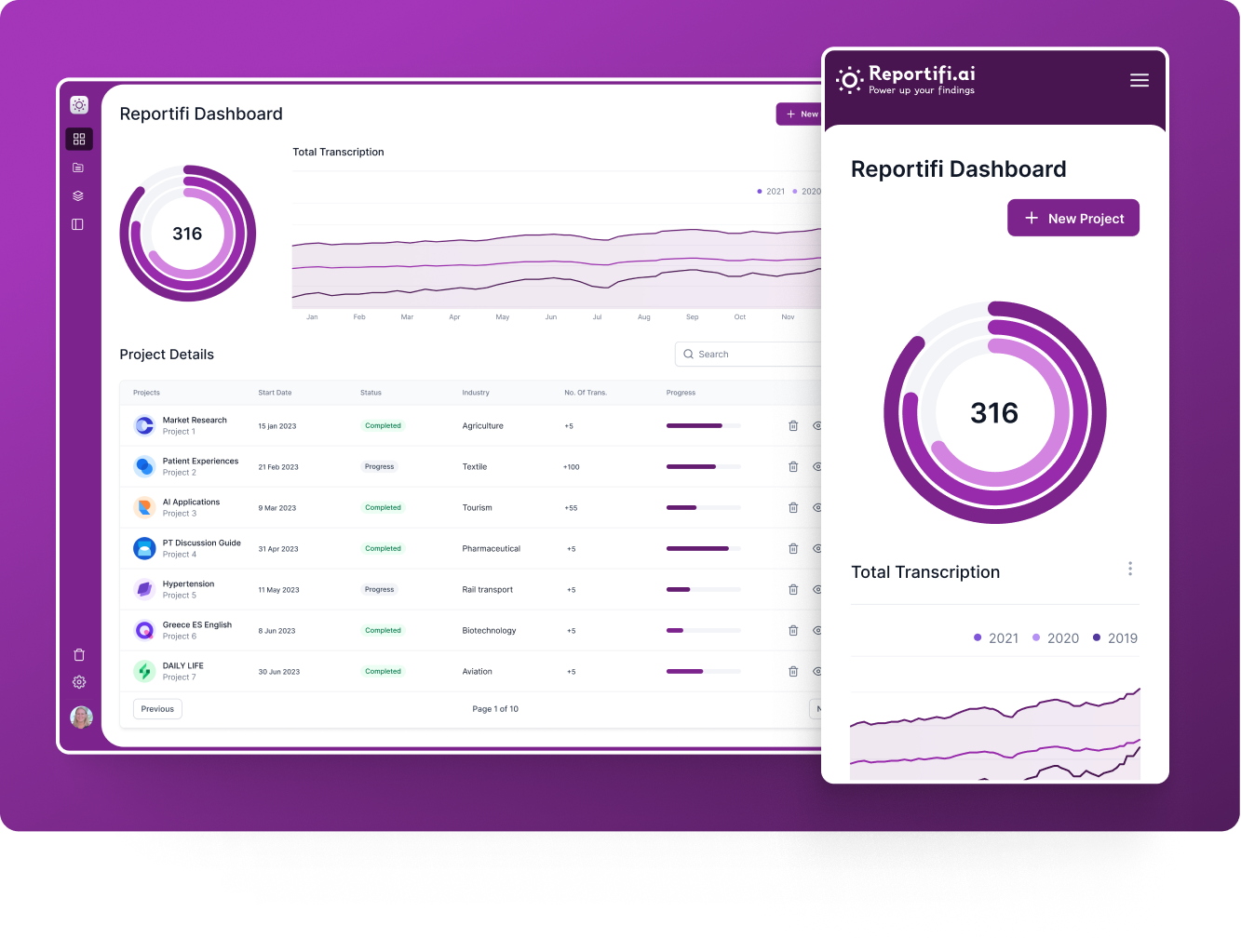

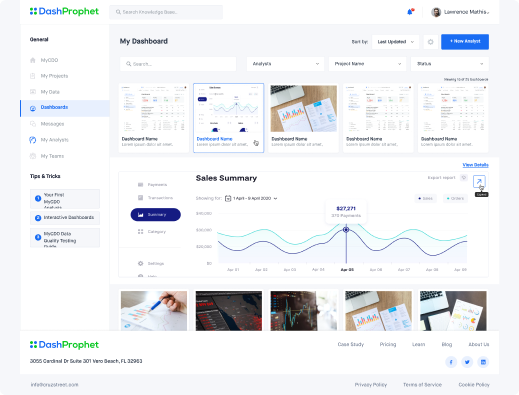

Project Overview

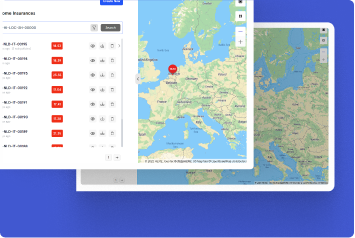

The main aim of the INSR project was to solve a long-standing issue of risk assessment in the home and motor insurance domain. With in-depth research and a robust design approach, we were able to develop a platform for insurance companies to quickly assess the risk involved in providing insurance based on geography, traffic, and a list of other factors.

Our task

Product Development

Dynamic Risk Engine Generation