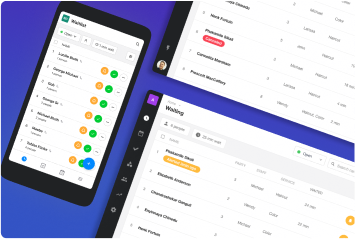

The American mortgage business is well known for its lack of simplicity. Moreover, lenders of prominent firms find it hard to track their potential clients. Every year, loan businesses lose millions in opportunity costs alone, never being able to track their progress.

Their current state of affairs was rooted in two fundamental flaws in the system

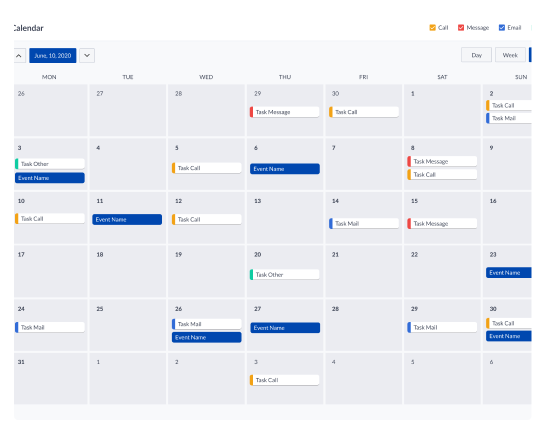

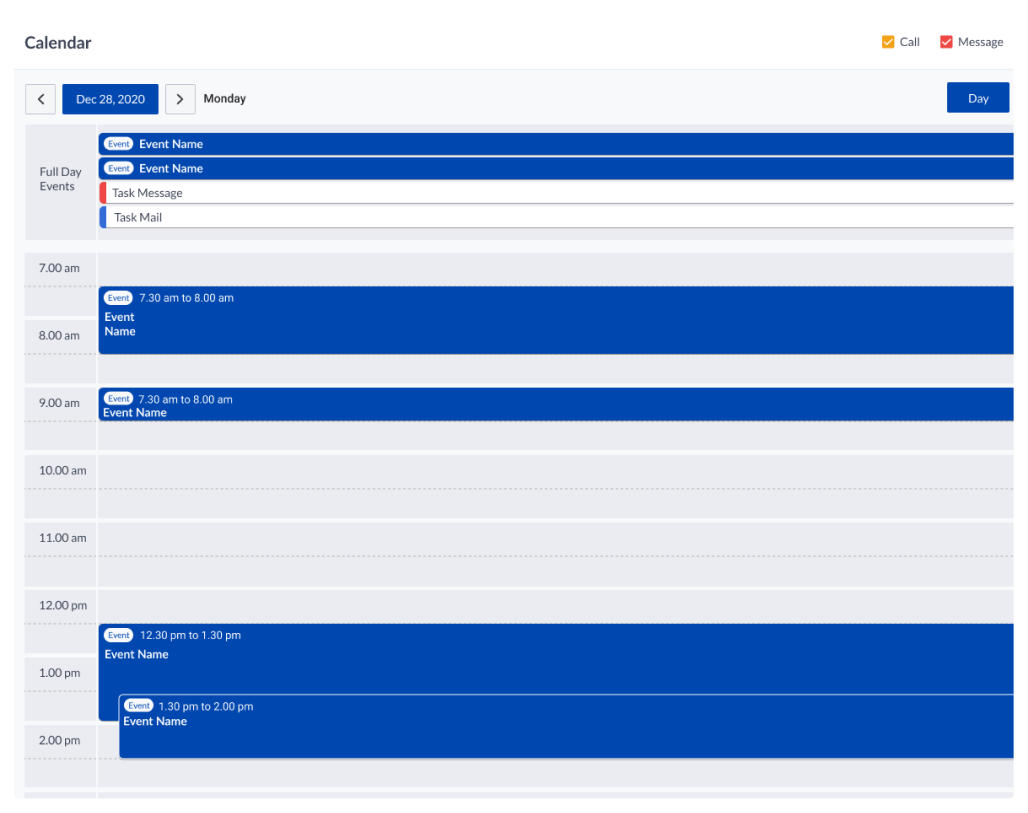

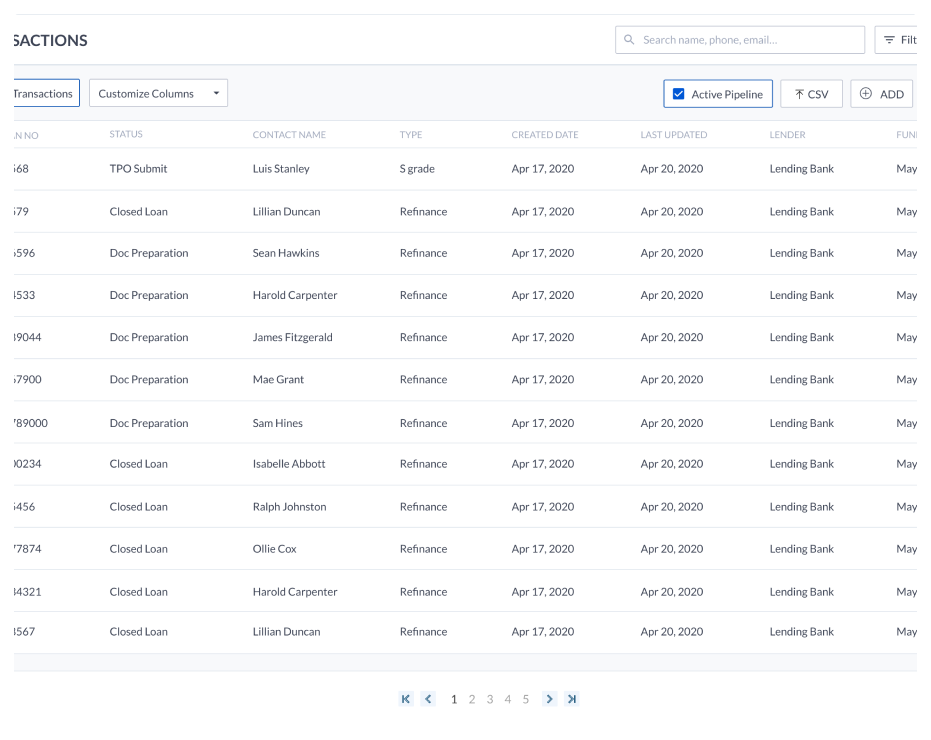

- Difficulty in tracking clients in their loan status

- Lack of marketing opportunities that limited lending opportunities for mortgage loan officers

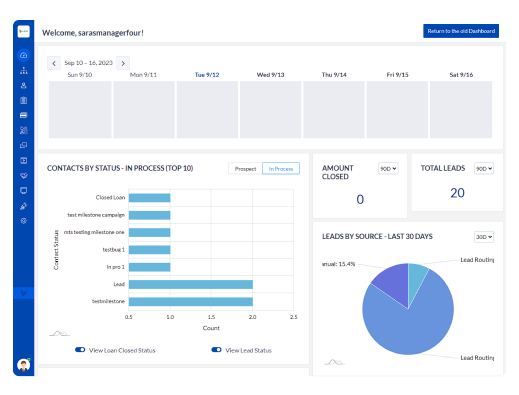

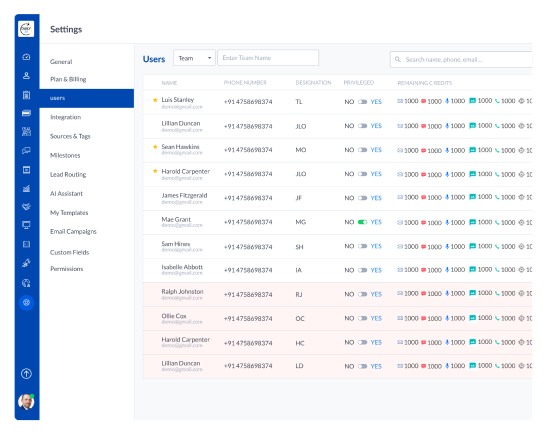

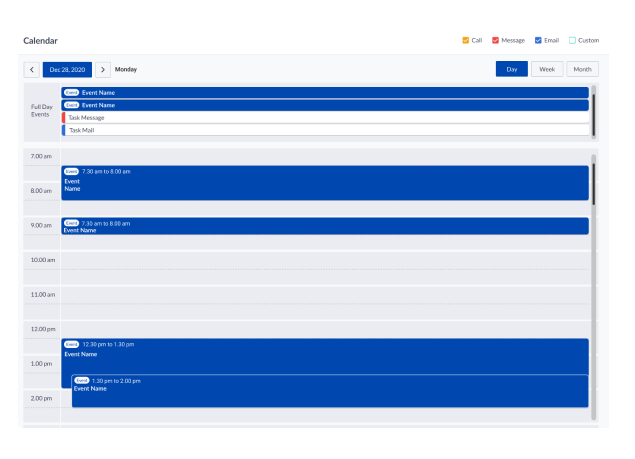

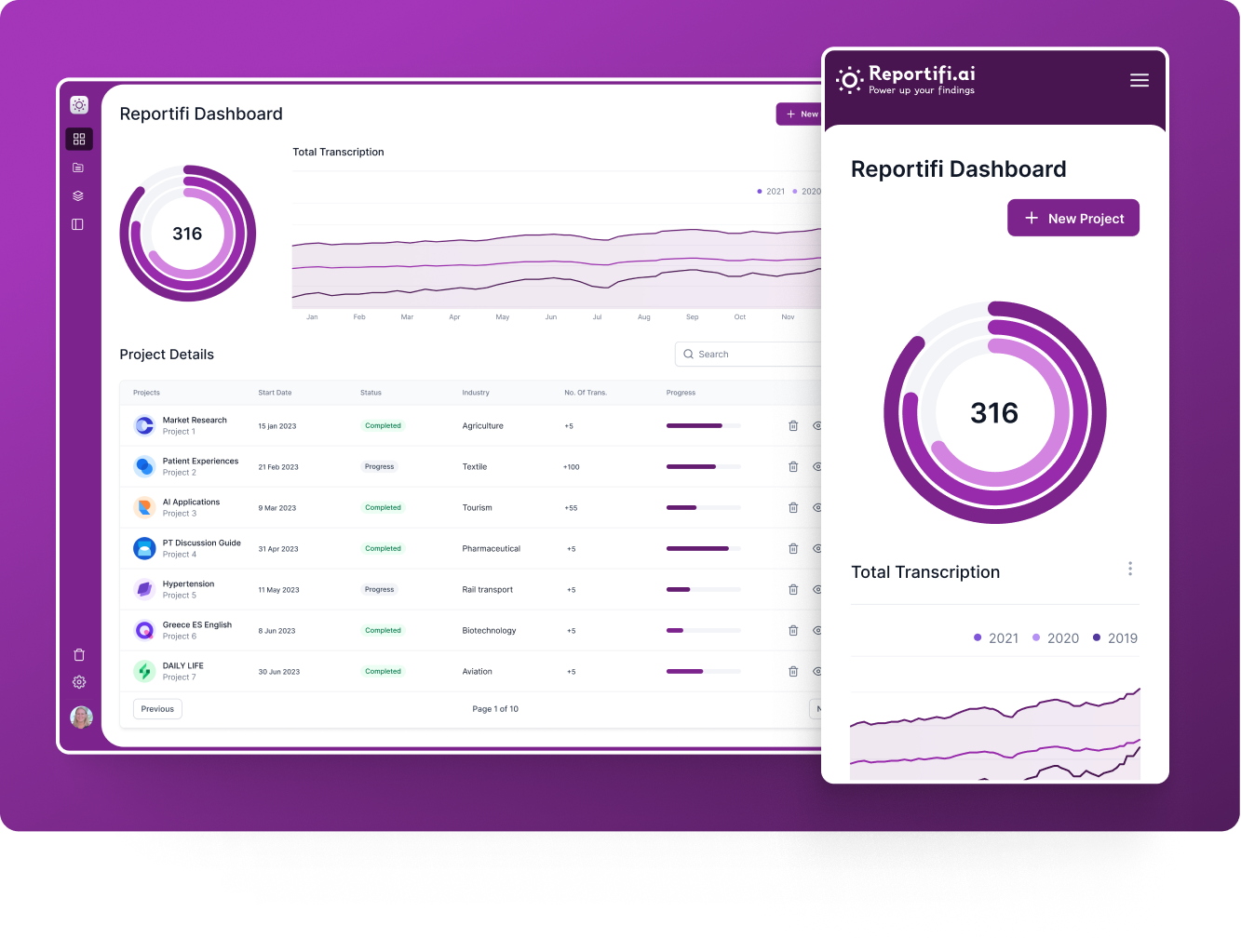

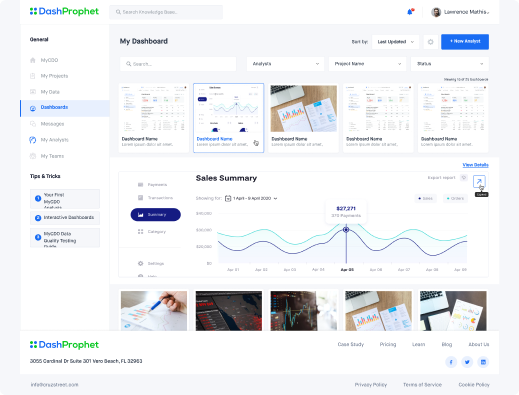

We found that creating a streamlined workflow could simplify work for lenders. A platform that could help them track their progress with each client could significantly improve their conversion.

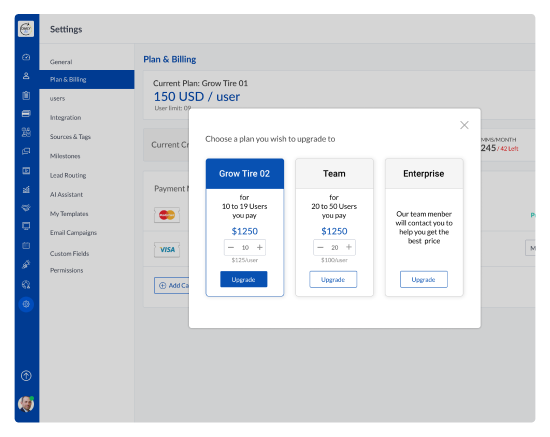

Combining the simplicity of the platform with marketing opportunities could truly be a game-changer for teams too.

So the choice was obvious: an easy to use, yet extensive loan management CRM for mortgage loan officers. Coupled with AI for automation, we envisioned a system that was both quick and intuitive in helping loan officers serve more clients without hassle.